Alternatively, use the money to pay off a debt. Or check out the 30-day savings method and 50-30-20 rule to cut down on overspending. You can ensure you do not have money to buy things online by saving all the money left after catering to your monthly expenses. Online shopping is quite convenient, but you may end up with unnecessary purchases unless you are disciplined.

For example, if you’ve exhausted your Netflix list, cancel your subscription until a show you’ve been waiting for is added. Unsubscribe to any advertisements or e-mail newsletters that might lure you into re-subscribing. No matter how small a subscription fee is, several of them can quickly add up to hundreds of dollars. However, you still pay for it every month. Often, once you subscribe to something such as a publication, streaming service, internet, and so on, you no longer think about it. Having a list helps you resist the urge to buy something just because you think you might need it. Avoid justifying an expense just because an item that is not on your list is on sale. Prioritize your monthly purchases and avoid spending on things that you do not really need. You will need to come up with a grocery list a few days before going to the store. Some of the ways through which you can minimize unnecessary expenses and discover easy ways to save money include: It would help if you asked yourself such questions as: Once you have your budget, a money goal, and ask yourself how much should you save a month, scrutinize everything you spend your money on.

#Calculate monthly expenses how to

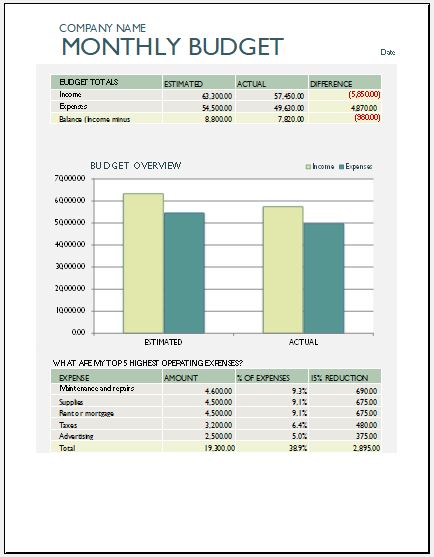

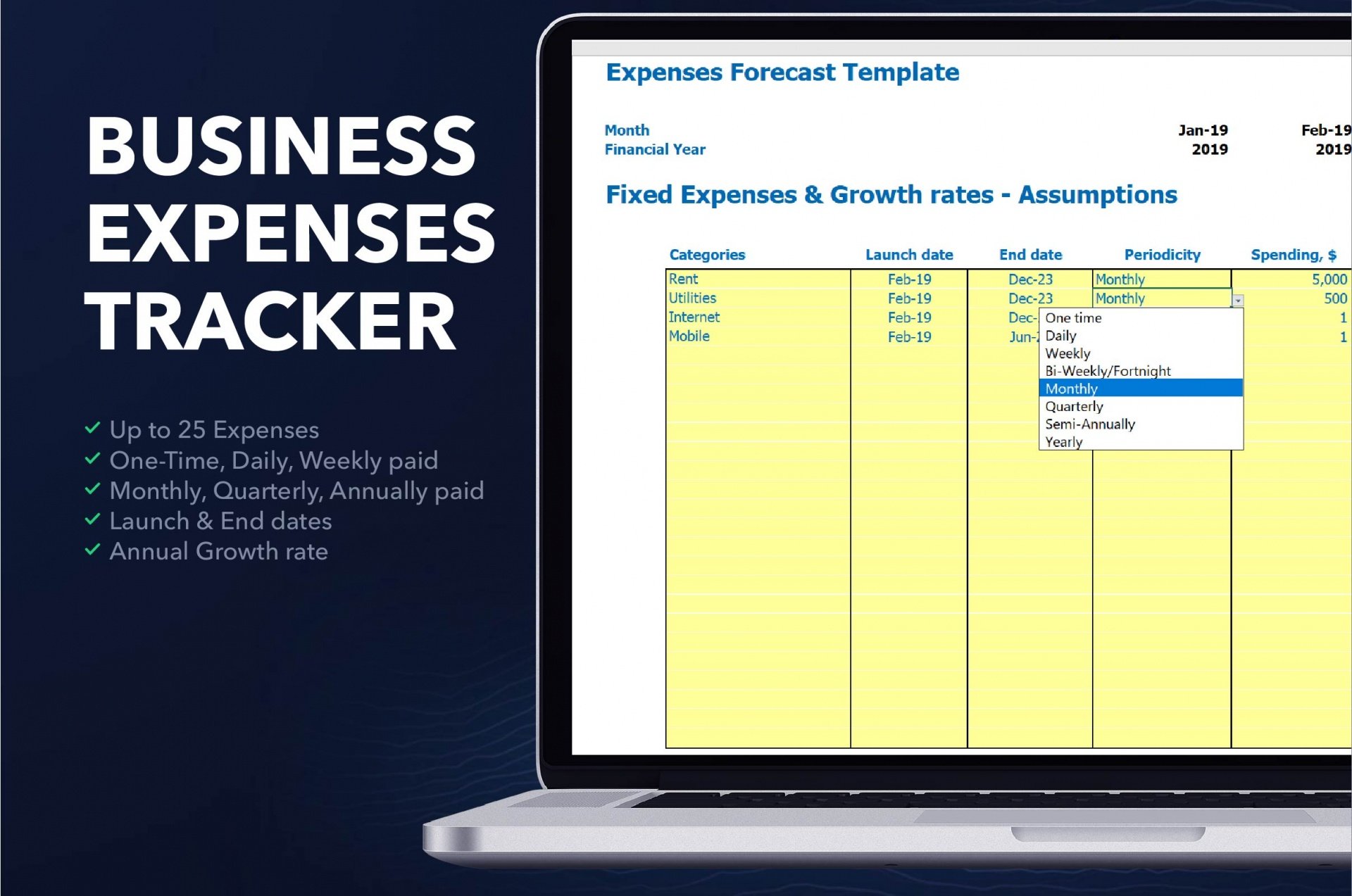

How to Identify and Stop Spending Money on Unnecessary Things This calculator will help you get a clear picture of the money that gets into and out of your account. You can use an online monthly expense calculator to generate your monthly budget. For the latter, you can get an average by looking at the amounts you have spent on each over the last three or four months. Likewise, the money you spend on groceries and utilities may vary from month to month, but you need them.Īssign a value to every category, beginning with the fixed expenses and moving on to the variable expenses. For instance, vehicle repair and maintenance is a variable expense, but it is necessary. Although most variable expenses are optional, some could be necessities. They are a representation of your daily spending habits. Variable expenses: As the name suggests, variable costs vary from month to month.They include mortgage payments or rent, insurance premiums, car loan payments, bank fees, and debt payments if you are on a debt repayment plan.

Fixed expenses are likely to take up a considerable percentage of the budget.

To successfully cut back on unnecessary expenses, it is essential to understand everything about your monthly transactions. It may take some work initially, but it will ease your financial stress and help you save more and pay off your debts quicker. The key lies in cutting back on unnecessary spending. For millennials, it is especially tough to figure out how to organize your finances and save while on a small budget. A significant aspect of figuring out your personal finances, and financial literacy, is finding the best way to utilize your money.

0 kommentar(er)

0 kommentar(er)